Wednesday, November 4, 2009

Thursday, July 23, 2009

Under 20k!

Next June will actually be my 20th anniversary since signing my first student loan promissory note. I would have never, ever done it if I knew I would still be paying 20 years later! I plan to celebrate but haven't decided what to do yet.

Wednesday, April 1, 2009

Whiddling Down ...

My goal is to pay off the remaining balance by June 2010. I don't know how I'll celebrate when I mail in my final payment (or receive my "paid if full" letter). Any suggestions?

Tuesday, March 10, 2009

Marty Nemko's Career Advice Website

His website and blog hit such a nerve with me, that I relayed my pathetic story to him via e-mail. He responded and was very kind.

I highly recommend giving Dr. Nemko's site a read!

Tuesday, March 3, 2009

Out #1: Earn More Money to Make the Student Loan Payment

Everyone immediately jumps to the conclusion they should go back to school for a degree in order to make more money. This also has the added benefit of deferring any student loans you have. Unfortunately, you will plunge into more debt, and you may be in the same boat when you graduate. Earning your degree is a gamble as there is no guarantee that you will be able to get a job or the salary you expect.

If you do proceed with college, go for an inexpensive certificate or two year degree. Many community colleges offer courses for less than $100 per credit. Blue collar jobs often pay as much as those requiring a Bachelors or Masters! Usually hands on, technical skills have the highest ROI (Return On Investment).

You can also learn on your own. Do not underrate this. It demonstrates that you are motivated, a self-starter and responsible.

If you have a skill that is currently in demand, you can teach a class. Check for teaching opportunities at local colleges, high schools (continuing education), and even some retail stores (such as Michaels if you are talented in the arts).

Starting a business is also an option, but usually requires a large investment of time and money. Research the possible drawbacks before proceeding.

Monday, February 23, 2009

Out #2: Spend Less So That You Will Have More Money to Make Your Loan Payment

The best tool for spending less is to create a spending plan. But you can't create a spending plan unless you know what you are currently spending your money on! The best thing to do is track your spending for a month or two. Every penny gets recorded! At the end of the month, gather up your financial records for the previous year (bank statements, canceled checks, etc.). With this information in hand, you are now able to create a spending plan. Time to start trimming!

There are many great reference books on how to create effective spending plans. I highly recommend Making the Most of Your Money by Jane Bryant Quinn. If your local library doesn't have it, you can request them to get it for you via interlibrary loan.

Ms. Quinn also lists some great ways to lower your expenditures. And there are many ways of doing this.

Shelter - I remember that in grad school every month I spent one of my bi-weekly paychecks on rent! If you are renting, try moving to a cheaper apartment or finding a roommate to share expenses. If you own your home, rent out a room to bring in some extra cash. You can eliminate a monthly housing payment altogether if you can mooch off a financially stable relative or friend for awhile.

Food - Each month half of my other bi-weekly paycheck that didn't go towards rent was spent on food! Coupons are a must for the thrifty food shopper. Shopping at more than one store is prudent. Watch the ads. Items go on sale in cycles, and you will learn to forecast when certain products will go on sale. Most of the time the same items will not be on sale at the same time at all stores. Buy in bulk. If the food will go bad before you use it, start a group of money-conscience shoppers such as yourself and buy together. Split the groceries among the group.

Clothing - Buy used from yard sales and thrift shops. If you want upscale clothing, goto thrift shops in wealthier neighborhoods. Depending on what you are making, you can save money by sewing garments yourself. But most of the time this is true only with clothes made from expensive fabrics (which you probably don't want to spend the money on, anyway). Alter and repair old clothes instead of buying new. If you don't know how to sew, take it to a seamstress and get a quote. Take boots and shoes into cobblers for repairs (such as worn sole).

If you belong to a church or house of worship, oftentimes they have programs to assist with basic necessities such as rent, utilities, food and clothing.

When buying anything online, google "coupons" and the store you will be buying from. Very often you will find a coupon that will offer you extra savings.

If you are thinking about going to college, research if the college you are interested in offers tuition breaks or waivers to employees. If it does, seek employment there. Most colleges (that I know of) offer tuition discounts or full-tuition waivers for staff and faculty (and sometimes includes spouses and children of staff and faculty too). Staff includes AAs (secretaries), janitors, grounds keepers, etc., so you don't necessarily need an education or training to work at a college! You can also look into whether your current employer offers tuition assistance.

Monday, February 16, 2009

Added Countdown to Freedom!

I am hoping to have the $28k balance paid in full by the middle of 2010 and preferably in May, June or July - the 11th anniversary of my last semester as a full-time student. It was the last time I took out student loans. It would take another 3 years (13 years after I left school!) instead of little over a year if I just pay the minimum! I will update the countdown monthly to reflect my repayment status.

Wish me luck!

Thursday, February 12, 2009

Out #3: Request a Forbearance or Deferment

Deferment: Student loan payments are suspended for a certain period of time due to a myriad of circumstances (unemployment, returning to school or economic hardship are most common). Interest will be paid by the government on subsidized loans during this period, but not on unsubsidized loans. If you don't pay the interest on unsubsidized loans during this time, it will be tacked onto the principal and it will compound.

Forbearance: Forbearance may be granted in cases where you do NOT qualify for deferment. Student loan payments are suspended or decreased for a certain period of time due to a myriad of circumstances. You will pay interest on both subsidized AND unsubsidized loans. If you don't pay the interest on either loan during this period, it will be tacked onto the principal and it will compound.

What does compounding mean? Essentially you will pay INTEREST ON TOP OF INTEREST. I will discuss this further in a future post. And while compounding interest is great for investors in order to build wealth, it is a nightmare for borrowers. Ever hear the old adage "money makes money?" Compound interest is one of the many reasons why.

Most pay dearly for this "out", and you can't delay paying your loans forever. If you have a $50,000 loan at 6% interest, you are paying $250/mo in interest. A 6 month deferment/forbearance results in $1,500 in interest alone! If it is not paid, the principal becomes $51,500! In addition there are limits to how long the government will pay the interest on your subsidized loan in the case of deferment.

Here is some further information for those having difficulty repaying their loans:

http://studentaid.ed.gov/PORTALSWebApp/students/english/difficulty.jsp

Pros:

- You will not go into default on your student loan

- Your student loan payment will be suspended or decreased temporarily allowing you time to get on your feet financially

- Deferment is essentially free for subsidized student loan holders

- The principal on your loan will not increase as long as you pay any accrued interest that you are responsible for

Cons:

- The principal on your loan will not decrease during times of deferment or forbearance

- The principal on your loan will actually INCREASE during periods of deferment (unsubsidized loan borrowers) and forbearance (unsubsidized and subsidized loan holders) IF ACCRUED INTEREST IS NOT PAID

Tuesday, February 10, 2009

Out #4: Return to School in Order to Have Previous Loans Deferred

I have employed this method to dodge paying my loans for awhile. I couldn't find a job after undergrad (please refer to My Story), and I didn't know what to do. I admit that this is the easy way out ... well, for a brief period of time anyway. And in a few years my student loans were back with a vengeance - bigger, badder and even more difficult to pay off!

I went back to graduate school even though I preferred to get another BS degree in a different Engineering discipline such as Electrical Engineering. It probably would have only taken a year or so to complete, but the rules about borrowing additional funds under the student loan program required that I attend graduate school if I already had a bachelors degree. BTW graduate school is more expensive than undergrad and more is expected from you. I still borrowed the maximum I was allowed at the time (around $8k per year, I believe) even though I had a Teaching Assistantship through the university!

Since I didn't have all the required undergraduate classes for an Electrical Engineering Masters degree, I had to take undergraduate classes my first year but still pay the graduate rate. What a racket!

I ended up in the same boat I was in before graduate school, but this time a LOT more in debt.

If you return to school, do your best not to borrow additional funds! In the future I will suggest ways of doing this. Of course, the methods I will discuss are not suitable for everyone. If you go back to school and must borrow money, do your best to minimize the amount.

Pros

- Your student loans will be deferred while you are attending college full-time

- The degree you receive MAY help you to obtain a higher paying job

- You will hopefully be more educated which is something that nobody can take away from you (although you may end up wishing that it could be repossessed to pay off accumulated student loan debt)

- Interest on subsidized student loans will be paid while you are in school

Cons

- You may not be able to borrow to enroll in a bachelors degree program if you already have a bachelors

- The degree you receive MAY NOT help you to obtain a higher paying job or the pay may not be as lucrative as you thought

- The job market may change while you are in school and jobs in your chosen field of study may temporarily or permanently dry up

- If you borrow money, it will be additional debt to what you started with (and hence a higher monthly payment when you leave school)

- For whatever reason you may need to drop out of school, and would have spent time and money towards a degree that you don't have and can't use to obtain a job

- Unsubsidized student loans will continue to accrue interest and will be tacked onto the principal of your loan if you do not pay the interest while in school

Monday, February 9, 2009

Out #5: Skip Out on the Payments and Ignore the Collectors

If it comes to a choice between paying student loans and paying rent or buying food, most will opt for the latter. And while declaring bankruptcy will rid you of almost all of your other debts, your student loans will stick with you through thick and thin. It's like being married to a blood sucker with no option of divorce.

So, say that your are in a position where you KNOW you will never get on top of your student loans. For example, here is an article from CNN of a music student, Chris, who took out $160k in student loans thinking his payment would be $600 per month:

http://money.cnn.com/2008/10/23/pf/college/student_loan_fugitives/index.htm

Sadly, at $600 a month he would never be able to repay even a 6% interest loan! So, what did he do? He took off overseas.

It is unfortunate that he felt his situation so dire that he needed to leave the country. Fugitive students start their lives over again in a foreign land. Most often the student loan creditors don't go after these fleeing debtors as they are difficult to track down, and it costs the lending agencies a great deal of money to collect.

How about if you just stop paying and stay in the country? Well, your creditors will harass you; they will garnish your wages; they will take your tax refunds; and they will destroy your credit leaving you unable to purchase a home, and sometimes will cost you employment opportunities or apartment rentals. Oh, and those that are in default are unable to secure additional student loans if they need to return to school to retrain.

While I usually don't support ditching your student loans and leaving the country, what kind of life will students have who over borrowed and can't pay? Even those who over extended themselves on mortgages they can't afford and consumer debt have a chance to begin their financial lives again through bankruptcy.

Chris and Carl (the other student discussed in the article) are not alone in their plight. Read the user comments attached to the story. There are many in similar circumstances as well as a few that even exercised this option themselves!

Pros

- You will not have to pay your student loans while you live outside the United States since your whereabouts will be unknown to your lenders

- You will not be harassed about paying your student loan (as long as your creditors can't find you)

- You can start over with a clean slate in a foreign land

- Money you earn outside the United States will not be garnished

Cons

- You will not be able to come home to the United States without the possibility of punishment for dodging your student loans

- You may feel guilty about relinquishing your responsibility to repay your debts

- If you do return to the United States, expect your total student loan debt to have grown exponentially as fees will be tacked on and interest will continue to accrue and compound

Saturday, February 7, 2009

In a Hole with No Way Out

(1) earn more money to make the payment;

(2) spend less so that you will have more money to make the payment;

(3) request a forbearance or deferrment;

(4) return to school in order to have previous loans deferred;

(5) skip out on the payments and ignore the collectors.

I remember finding myself in this situation 15 years ago. I was already licking the pavement financially, so option (2) was out of the question since I couldn't spend less. For about a year, I searched in earnest for an engineering job that would allow me to pay my loans but was unsuccessful. Although my loans were in unemployment deferrment while I was looking for work (3), I couldn't put them off forever! Most people feel responsible for their debts, as do I, so I didn't consider (5). So I opted for (4) and returned to school. I also felt that if I had a recognizable advanced degree, I would be more employable. But there was one problem: I really didn't want to return to school. My heart just wasn't in it. And I am not alone. There are many returning students who borrow more to avoid the payments to the ghosts of student loans past. It can become a vicious cycle leading into more and more debt.

Could I have found another way? Probably. I didn't think it out as thoroughly as I should have. Also, I was young and really had no life experience backing my decisions. If you find yourself in the same situation, it is time to think what the best thing for you to do.

Next: Exploring the 5 methods of dealing with student loan payments you can't currently afford

Tuesday, February 3, 2009

Not Everyone Needs to Attend College

So, say you you work hard, study and get a college degree. Does that mean a job and a good salary when you graduate? Well, no ... it meant unemployment and a huge amount of student loan debt for me. And I'm not the only one. John Stossel hosts a wonderful segment aired on 20/20 addressing the value of a college degree:

Some Debt-Laden Graduates Wonder Why They Bothered With College hosted by John Stossel (01/16/2009)

Essentially, the segment points out that students who graduate from college often end up working in permanent jobs that only require a high school diploma. It also mentions that most higher education institutions provide an inflated statistic of starting salaries for their graduates which was absolutely true in my case. I will discuss how those misleading statistics are arrived at in another post.

Can you begin a career with just a high school diploma? Is there any hope for you to have a successful financial life without a bachelors degree?

Absolutely.

But like with most things in life it depends on many interdependent factors. What kind of person you are and what kind of work you like, the effort and time you are willing to invest, how intelligent you are, and your ability to learn new concepts. I see many high school graduates working low paying jobs like those at McDonalds, but if they make enough money to survive and are happy doing it, then who am I to judge? I have also witnessed many high school graduates start or become partners in businesses that grow and become very lucrative.

An alternative is to continue on with a formal education after high school, but keep the cost and time invested to a minimum. My mom has an AA degree in a medical field, loves her job, paid off her student loans in 5 years, and made more than me since 1999 just up until recently! There are technical schools for a variety of areas such as the plumbing and electrical fields. And before you look down on those occupations, they make damned good money, we need them AND their jobs can't be off-shored!

You don't need to earn a boat load of cash to make it through life. The key is to live on less than your earnings, avoid debt, and build wealth (I will discuss this in another post). However, if a high salary is important to you, here is a list compiled by the government of high earners that don't require a bachelors degree: High Earners Who Don't Have A Bachelors Degree.

But how about if your dream job requires an advanced degree? To work as an engineer, I was required to earn a BS. But to be honest, there are some that have worked along side me with 2 year degrees in computer programming. Moreover, I know of at least 2 jobs that I didn't get because they went to recent engineering technician graduates (2 year degree) instead! The employers felt they learned more job applicable skills (which was true). Expect to attend college 6 years or more for careers as a medical doctor, almost any psychology related field (clinical, behavioral, cognitive, etc.), and law. EVEN THOUGH SOME PROFESSIONALS MAKE A LOT OF MONEY IN THESE FIELDS, IF YOU ARE FINANCING YOUR EDUCATION WITH STUDENT LOANS, YOU MAY BE LEFT WITH ALMOST NOTHING AT THE END OF THE MONTH AFTER PAYING YOUR STUDENT LOAN PAYMENT. Don't believe me? Enlighten yourself, and do some searching through blogs. Blogspace is filled with these poor, peeved professionals complaining about their burdensome student loans.

When I was in graduate school, I met a debt laden lad who recently graduated with his PhD in clinical psychology. Stress of his work and student loan debt consumed this poor soul, and he said if he had to do it all over again, he would become a janitor.

So would I.

Monday, February 2, 2009

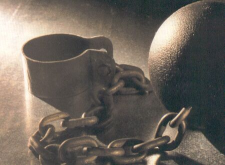

Student Loan Debt = Slavery

First, lets explore what slavery means. Looking at the definition of slavery at dictionary.com it reads "severe toil; drudgery; the state of being under the control of another person".

Second, what does holding a student loan debt, or any monetary debt in general, really mean? Of course that you owe money to someone. Usually the lender, or creditor, expects those funds lent to you paid back over time plus interest.

This is what most people think of when they think of debt. However, there is more.

What are you actually doing when you borrow money and create a debt? You are spending your future earnings! This is extremely risky since you really aren't guaranteed what your future earnings will be. Even if you've worked the same job for the past 20 years, how do you know that it will be there for the next 20? How about if you get sick or disabled and can't work? Borrowing against what you think you'll be making isn't exactly slavery. But there's more.

Time is money, and money is time. Life is made up of time, and we only have a limited and unknown amount of time on this Earth. Ergo,

MONEY = TIME = LIFE

When spending future earnings (i.e., borrowing money), future LIFE is spent too!

Essentially, you will spend a portion of your life toiling to pay your creditor his original investment PLUS his profit which is OWNED by him. So he owns your future money ... your future time ... your future LIFE. And the greater the sum you borrow, and the higher the interest rate, the more of your life he will own.

Sounds like slavery to me!

Of course, the situation isn't as bad if you are making a wage that will allow you to repay your debts quickly. You will spend less time working for someone else, and more time working for yourself. The degree at which you are a slave to your lender is relative and dependent on how much of your life is spent "settling up" with your creditor.

But how about if you over extend yourself? Declaring bankruptcy will clear your debt, and you will start with a clean slate.

NOT WITH STUDENT LOANS!

It is extremely difficult to erase student loan debt. The only way is to prove "undue hardship" which essentially means that you are either dead or in a vegetative state.

So a student loan, both government and private, serves as the proverbial "ball and chain" for many borrowers who were ironically searching for a "better life" through education when taking on the original debt. What if you find you cannot afford to pay your student loans back? Student loan creditors are backed by a fortress of laws to protect THEM. Unfortunately, there are few laws protecting student loan borrowers unlike those with consumer debt (credit card) or mortgages. You will be harassed by lenders, late fees tacked onto your principal loan amount, your wages or social security benefits garnished, and tax refunds intercepted. And this is until the day you die. Your student loan will snowball into a huge amount that you will never be able to pay off (unless you hit the lottery). How does this happen? Compound interest - which I will discuss in a future post. Your life long enslavement will be guaranteed.

I am lucky. I took out student loans and can repay them. Well, for the moment anyway. I make a good salary only IN PART due to my education. I probably make a higher salary than I would have if I didn't have a degree. But does this insure greater wealth for me by retirement than someone who only earned a high school diploma or a 2 year degree? Hmmmmm, not necessarily. I will explore this in later posts.

Next: Not Everyone Needs to Attend College

Sunday, February 1, 2009

The Aftermath

If I raided my retirement accounts, I could pay my student loan in full. However, I don't want to pay the taxes and penalties associated with doing that. I would have used the money I invested into retirement to pay them, but I thought it more prudent to contribute the maximum that my employer would match. I don't want to throw away free money!

However, I am tired of my oppressive $900/mo student loan payment! My original loans totaled $65k. After my unemployment stints and a few hardship forbearances, the amount rose to $75k! I consolidated them in 2000 and now I'm locked into an 8% interest rate. At that time the rate was respectable, but now it totally sucks! As of this month (February 2009), the balance is around $28k. According to my payment schedule, I still have 3 more years of payments! So, this year I set this financial goal: as long as I remain employed and able to work, I will pay my student loan in full by December 2010 at the latest and July 2010 at the earliest. July 2010 is very aggressive, but I want my emancipation sooner than later! I will post my progress here on my blog. I will be shopping around for debt reduction tickers this week to make it all graphical and pretty. Although I am using an initial amount of $28k as a starting marker, here is a summary of what I've paid so far:

Original student loan amount: $65k

Ballooned student loan amount: $75k

Principal paid (as of February 2009): $47k

Interest paid (as of February 2009): $29k

I encourage everyone to share their stories regarding their struggles and triumphs with student loan debt. Also, during my remaining time in student debt slavery, I will be sharing what I learned in relation to finances, the higher education system and, of course, student loan debt. Please feel free to leverage your thoughts as well!

Have you been enslaved by student loans while seeking the "American Dream" of higher education?

Saturday, January 31, 2009

Graduate School or Bust (or should I say AND Bust?)

To make matters worse, I had to play "catch up" in Electrical Engineering. I took required undergraduate classes my first year while paying the graduate rate, of course. As I remember, graduate credits were about $100 more per credit than undergraduate credits. How nice of Generic University.

I began working on my Masters thesis, and subsequently I started to fall apart. The stress of trying to review undergraduate electrical engineering material, taking graduate classes, working almost full-time, trying to make progress on my thesis and money worries became overwhelming. I limped through 3.5 years of graduate school while suffering panic attacks and frequent illnesses. I went to the emergency room at least twice because I felt like I couldn't breathe. I believed if I could just finish my thesis, I would graduate. But I couldn't scrape together enough money for another semester, and I had a nervous breakdown. The hope and excitement I had as a naive high school graduate for my future education and career were distant and foggy memories. Fear and dread took their place. I packed it in and moved back home with my parents.

Back to where I started before graduate school, but this time with an additional $50k in student loan debt (which now totaled $70k) and $8k in credit card debt. I thought, "How could I ever pay back this much money?"

And that's how I guaranteed my enslavement for many years to come ... and which continues until this day.

The Year Long Job Search

One benefit of working for Mr. Jerk is that he purchased a huge engineering company database detailing company contact information and production areas of thousands of companies. It served as a great resource during my job hunt. I printed resume after resume throughout the year, sending them in 50 to 100 batches. The last total I remember was at 1200 resumes, after that I lost count. The response rate was piss poor at 1%-2%. This meant that for every 100 resumes I mailed, I received one or two interview invitations. What was worse is that it was expensive. At the time each resume and cover letter ensemble cost 75 cents which included the paper, envelopes, printing and postage. And the interview expenses were often not reimbursed by the company. It astounded me how expensive job searching was!

I toiled away in unemployment hell which led me to increasingly wallow in self pity. As the year progressed, I became extremely angry and depressed. "This isn't how it's supposed to be!" I exclaimed to my mother. "That's life," she replied. Ah, she always knew how to make me feel better. NOT!

I couldn't get a job because (1) the economy was in the throws of a recession, (2) potential employers didn't know what Engineering Science was, (3) they felt my degree was too general when they came to understand what the subject was, and (4) I had no experience or hard skills. The last item is pretty important as how can one acquire experience when nobody will hire them to develop said experience? Suddenly I strongly regretted not doing an engineering co-op / internship while in college. Oops, too late!

I also made an unsettling discovery. The starting salary quoted by Generic University for recent graduates with my degree was grossly inflated. Quoted at $35k per year, the salaries I found were to be more like $25k-$27k per year (I will discuss this further in another post).

My student loans were in deferment during the year. The payments were in the grace period for the 6 months after graduation, and in unemployment deferment the remaining 6 months. Wasn't that kind of my lender? Just tacked the interest right back onto that baby so it could snowball into an even bigger sum of cash to repay ....

As the year after graduation came to a close, desperation sat in. I couldn't put off my paying my student loans forever, could I? Then I hatched a brilliant plan - the perfect plan - or so I thought. "Hey, why don't I go back to school and earn my Masters in Electrical Engineering. Everyone knows what Electrical Engineering is. I will definitely be more employable! And an added bonus is that my student loans would go into deferment again without accruing interest ... sweet!"

So I was off to grad school the autumn a year after I graduated from undergrad to realize my fool-proof plan. It wasn't a labor of love, and I lacked true desire for a graduate education as I still felt mighty burned by my undergraduate experience. I entered grad school angry, depressed, resentful and in poverty.

Oh, did I mention that grad students are allowed to borrow obscene amounts of money to fund their education? Ah yes, and I borrowed the maximum amount I could. "I will make more than enough money with a graduate degree to pay these loans off during the first few years after I graduate."

Those who don't learn from history are doomed to repeat it.

Next: Graduate School or Bust (or should I say AND Bust?)

Friday, January 30, 2009

The Beginning of the Student Loan Debt Spiral – Undergraduate School

There wasn't anytime during my high school existence that I doubted a career in Engineering was in my future. With my mother sitting beside me, happily I expressed my plans to my guidance counselor. She replied "Well, you won't have any problem being accepted into the school of your choice. You won't have to pay a dime for college with your grades. You will receive scholarships and grants." Now, looking back I think my mom should have known better than to believe this, but alas, she and I both fell for it hook, line and sinker.

And as my guidance counselor predicted, I did get into the school of my choice,

Ready, Set, Go … Let the Borrowing Begin!

I registered for summer session to get a jump on fall! An excited youth, I wanted to get through school quickly and start my promising career. This halted almost immediately. "What's this?" I asked my mother. "Looks like a tuition bill," she remarked in surprise. Turned out that

Needless to say, I couldn’t scrape together the cash to go summer session. I quickly filled out the financial aid paperwork, and lo’ and behold I received $0 in financial need grants. My father made too much money, however, he had quit his job in May (long story), and I was supposed to start school in September. My parents refused to pay for any of my college studies even before my Dad quit his job. I worked as a cook in a semi-upscale restaurant making close to minimum wage, and I was the only one employed in my family. Even with working 20-30 hours a week at that job and commuting to school (using my out-of-work father’s car), I could not pay cash for my entire freshman year. Student loans to the rescue! “Oh, with an engineering degree, you’ll have that loan paid off in no time,” advised my mother. At 17, I began plunging myself into debt that I still haven’t expunged myself of after 20 years.

Oh, and here is the level of required counseling I received by the school when I signed my first student loan papers: we watched a 20 minute video. It was a lame vignette of some chick who ditched paying her student loans, and years later when she wanted a credit card, she couldn’t get one because of her defaulted student loans! Oh, the horror of lacking the ability to rack up more debt on credit cards!

Student loan debt (end of freshman year): ~$2.6k

The Credit Card Habit Begins

I loaded up on credits, 18-20 per semester, to get as much for my money as I could (any credit above 12 credits was “free”). Starting college at the beginning of a recession, and with hours and other jobs hard to come by, I worked as many hours as they would offer at the restaurant during my freshman year. My father found a job and moved the family during the summer between my freshman and sophomore years. This had dire consequences for me as I could not longer commute, so I moved on campus. The student loans didn’t cover it, so I convinced my parents to borrow under a PLUS loan, and I would pay it. It was only $50 per month, however, when you have no money, $50 is a lot. And I paid it, on time every month, for 10 years until fully paid. Looking back I don’t know how I did it some months.

Taking out a credit card seemed like a good idea at the time. I didn’t have money for books even with the loans I had. I worked, but didn’t make enough. And I could quickly pay off those cards when I graduate with that lucrative engineering job, right? The balance quickly soared to the $500 limit.

Student loan debt (end of sophomore year): ~$5.2

Credit card debt (end of sophomore year): ~$500

Dream Turned Nightmare

I became eligible for financial hardship grants by my junior year. My father made only 40% of the salary he earned at his previous job. However, my mother decided to attend school to earn an AA in a medical discipline and essentially all the grant money went to her! Since she is the parent, and on paper she contributed to at least 60% of my college expenses, her need became “greater” than mine. Since I wasn’t living at home and supported myself during most of the year (I lived with my parents for two summers during college), I asked if I could claim myself independent. My parents refused citing that my mother would lose her grant money and their tax write-off! Also, my parents believed that since I would be an engineer, I would easily secure a job and pay off my loans upon graduation. But hey, the counselors in the financial aid office said the same thing. Smart girl like me with lots of potential will get a job and pay off those loans no problemo. Yeah, right. If I was so smart, I wouldn’t have willingly delved into such a financial mess! I’m a dumbass.

To make matters worse, my junior year was disastrous. Upon the advice of my parents and college counselor, I didn’t work. The counselor said, “The junior year engineering curriculum is very challenging. You need to have the time to focus and study, so don’t use the time working.” I followed the advice, but instead I spent the time worrying about money. I didn’t even have money for laundry, and I often washed my clothes in a laundry sink and hung them in my room to dry. Not working was a BIG mistake! This was the first semester I didn’t make Dean’s List.

What? … I Can Work in Any Engineering Discipline? Sign Me Up!

On top of the money situation, I followed my friend’s advice (who was a professor at

However … if it sounds too good to be true, it usually is. In general the faculty in Engineering Science is slanted towards Mechanics and Material Science (the department is actually called Engineering Science and Mechanics, but the degree is only Engineering Science). I strongly disliked Material Science. Guess what? All the coursework had a Material Science bent! I hated it, but I felt trapped. If I changed majors, how would I pay for my last semester with subsidized student loans no longer available?

Of course looking back, there were ways. But in the frazzled mental state I was in, I just didn’t see them and didn’t take the time to give it thought and brainstorm potential solutions.

BTW I went back to that friend in my senior year and told him what Engineering Science really was. His reply? “Oh, I didn’t know.” Well, neither did the majority of my Engineering Science classmates. They felt lied to about the promises the Engineering Science department made as did I. And as I began looking for work after graduation, my negative feelings regarding Engineering Science would become much worse.

Student loan debt (end of junior year): ~$10k

Credit card debt (end of junior year): $1k (limit raised to $1k!)

Graduation: Gift or Curse?

Senior year is a blur to me. I disliked my coursework. I passed up an opportunity to co-op because I believed graduating as quickly as possible would be best (another BIG mistake – which I’ll discuss in another post). There were times I only had a few cents to my name, and I was in despair. I did graduate with an Engineering Science degree and a minor in Mathematics – in addition to a severe case of depression. I was so disgusted with myself, my choices and my degree that I didn’t even retrieve the piece of paper from the registrar until several months after I graduated.

blur to me. I disliked my coursework. I passed up an opportunity to co-op because I believed graduating as quickly as possible would be best (another BIG mistake – which I’ll discuss in another post). There were times I only had a few cents to my name, and I was in despair. I did graduate with an Engineering Science degree and a minor in Mathematics – in addition to a severe case of depression. I was so disgusted with myself, my choices and my degree that I didn’t even retrieve the piece of paper from the registrar until several months after I graduated.

Student loan debt: ~$15k

Credit card debt: $2k (applied and received more credit cards!)

What I Learned in My Undergraduate Education

What did I learn in undergrad? Do not take advice from anyone unless you KNOW that they are aware of what they are talking about! Do your own research into options you have, and do some homework. Often you can’t easily go back and change the choice you’ve made. And that choice has the potential of bringing you reward or pain for years to come!

In my case pain … because as I said, I’m a dumbass. Just because I’m an engineer and a “logical” thinker doesn’t mean I can’t be naïve and make poor decisions.

Finally … Time to Start a Career!

Even though I moved back in with my parents due to severe poverty, the autumn after I graduated brought me new hope. Even though I was saddled with over $15k in student loan debt, $2k in credit card debt and a degree that didn’t live up to expectations, the depression lifted and with new vigor I researched techniques on resume writing, interview techniques and job hunting. The thought of beginning a career and paying off my debts brought me energy.

However, it became obvious as I started searching for work that nobody in industry knew what “Engineering Science” was. The only place that this HONORS Engineering degree held any clout was (and is) at

Well, I don’t think the student loan debt collectors will care about that …

Next: The Year Long Job Search

Thursday, January 29, 2009

The rich rule over the poor, and the borrower is servant to the lender. - Proverbs 22:7

Almost nothing is or will be as it initially seems.

Welcome to my Twilight Zone.